income tax rates 2022 australia

There are seven federal income tax rates in 2022. Individual income tax rates.

Australian Income Tax Brackets And Rates For 2021 And 2022

You are viewing the income tax rates thresholds and allowances for the 2023 Tax Year in South Africa.

. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. The next phase of the tax cuts will eventually remove the 325 and 37 marginal. The maximum rate was 47 and minimum was 45.

Australia Personal Income Tax Rate was 45 in 2022. State income tax is different from the federal income tax. FBTFringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years.

Tax Rates for 2022-2023. In most cases your employer will deduct the income tax from your wages and pay it to the ATO. In the long-term the Australia Personal Income Tax Rate is projected to trend around 4500 percent in 2022 according to our econometric models.

For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. Tax Rates 2021-2022. May 10 2018 The rates were modified rates to lift the 325 rate ceiling from 87000 to 90000 in the 4 years from 1 July 2018 to 30 June 2022 with further adjustments from 1 July 2022 and 2024.

Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. 6 rows Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. Australian residents pay different rates of tax to foreign residents.

A base rate entity for an income year is. 19c for each 1 over 18200. The income-tax rates for Assessment Year 2023-24 are the same as applicable in Assessment Year 2022-23 with However the rate of surcharge on long-term capital gain and AOP consisting of only company as member is capped at 15.

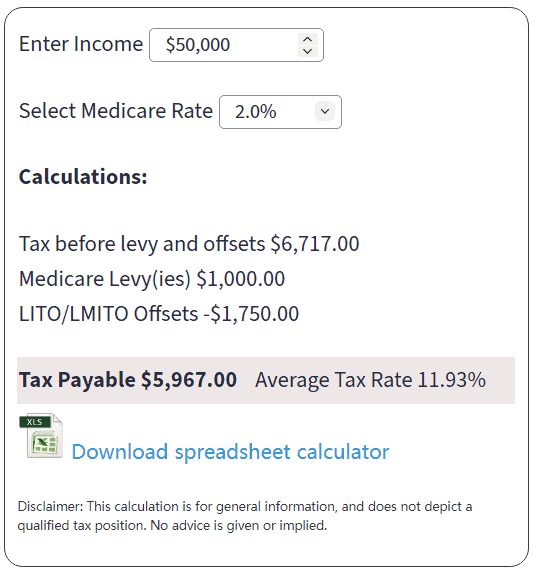

5 rows Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022. 29467 plus 37 cents for each 1 over 120000. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

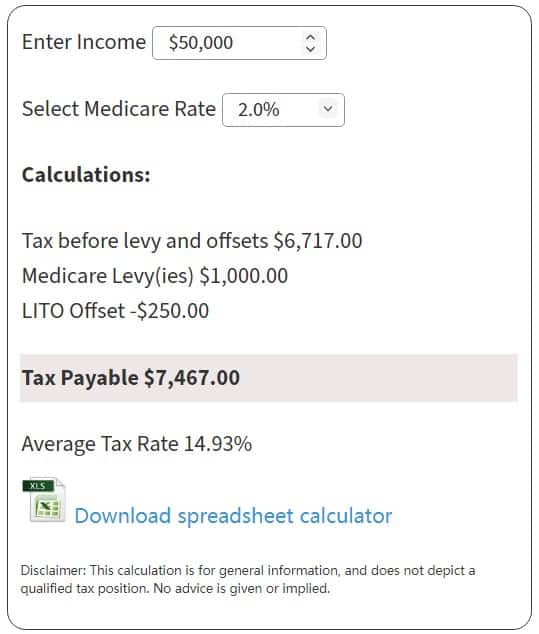

Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. Income tax calculator 2021-22 financial year October 18 2021. 2022 tax rates thresholds and allowance for individuals companies trusts and small business corporations sbc in australia.

Taxable income Tax on this income. Australian income tax brackets and rates for 2021 and 2022. 51667 plus 45 cents for each 1 over 180000.

An FBT rate of 47 applies across these years. In addition foreign residents do not pay the Medicare Levy or receive the Low Income Tax Offset LITO. A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022.

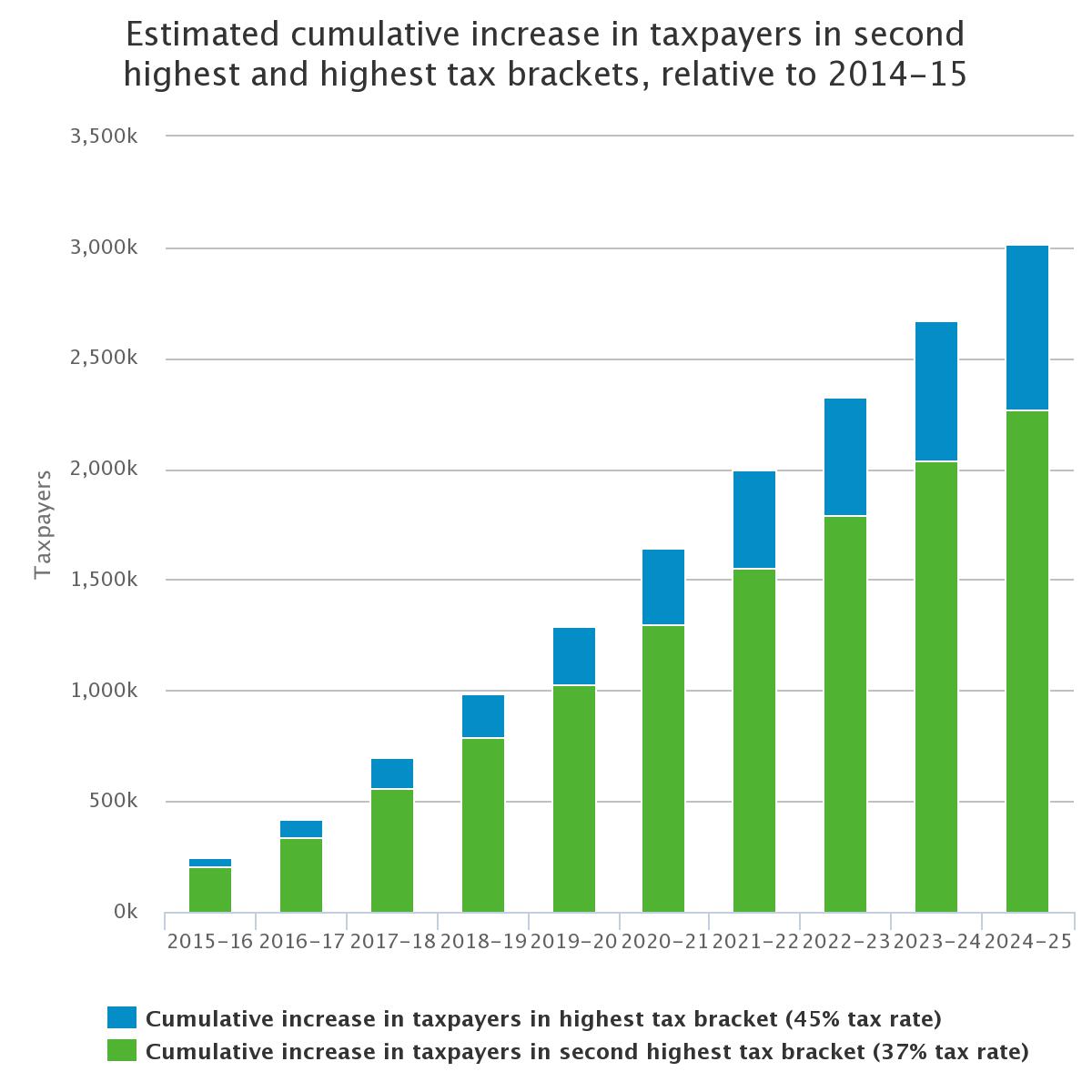

5092 plus 32. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500. The Australian government has implemented a seven-year Personal Income Tax Plan aimed to provide tax relief to individual taxpayers through lower PIT rates and Low and Middle Income Tax Offsets and an increase to the top threshold at which the 325 marginal tax rate applies.

Fringe benefits tax - historical rates and thresholdsHistorical fringe benefits tax FBT rates and thresholds for the 201314 to 201718 FBT years. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1. Income thresholds Rate Tax payable on this income.

Based on the Australian resident income tax rates above if Joe a hypothetical Australian taxpayer earned 125000 per year the tax he would need to pay could be calculated. Australia Residents Income Tax Tables in australia-income-tax-system. 19 cents for each 1 over 18200.

Tax on this income. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500. 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

Australia Personal Income Tax Rate was 45 in 2022. Australias income tax system is undergoing a radical overhaul designed to reduce tax for the majority of individuals protect middle-income earners from bracket creep and simplify the system.

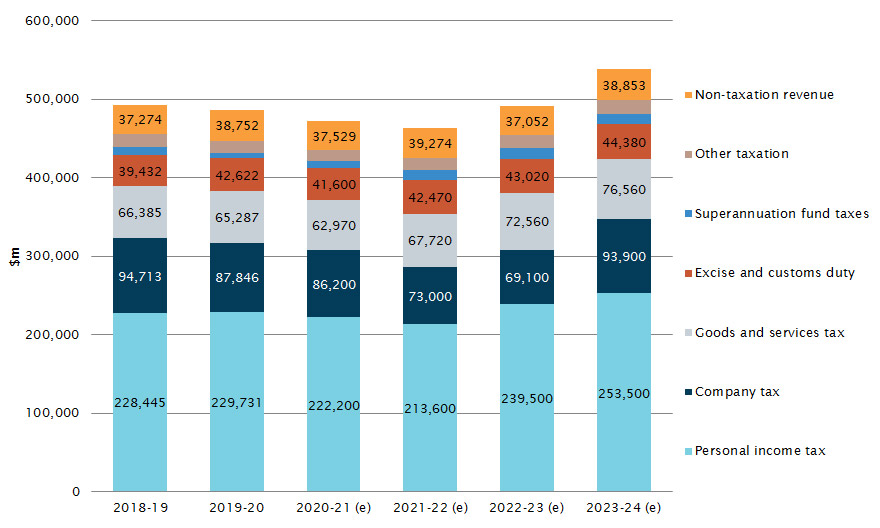

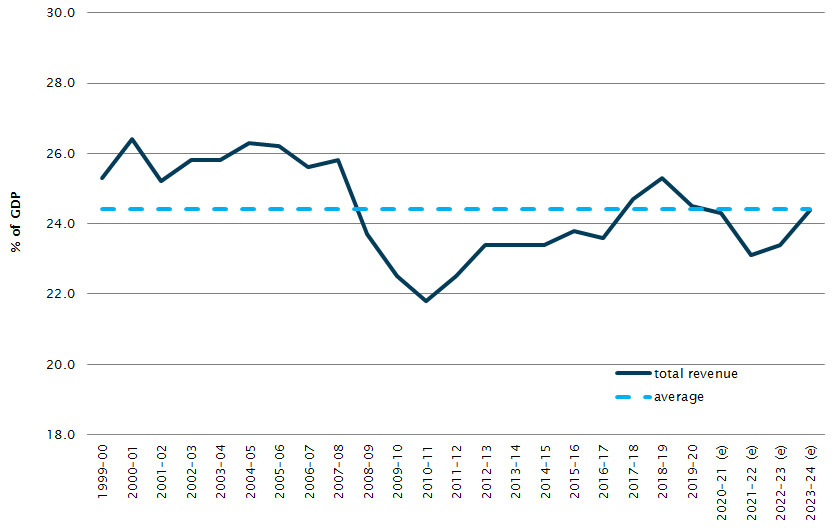

Australian Government Revenue Parliament Of Australia

Australian Government Revenue Parliament Of Australia

Tax Brackets Australia See The Individual Income Tax Tables Here

Australian Government Revenue Parliament Of Australia

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Australia S Personal Tax Take Second Highest In Oecd

Income Tax Brackets For 2022 Are Set

Income Tax Brackets For 2022 Are Set

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

Australian Government Revenue Parliament Of Australia

Australian Tax Rates And Brackets For 2021 22 Atotaxrates Info

Company Tax Rates 2022 Atotaxrates Info

What Are The Current Marginal Tax Rates Canstar

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

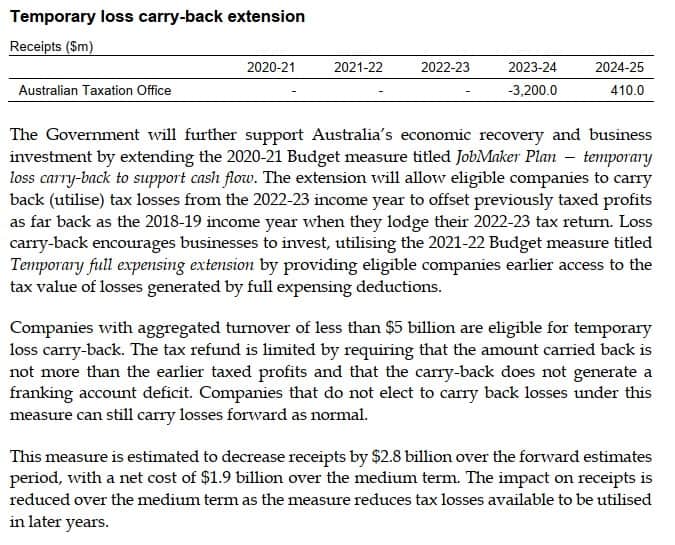

Budget Overview 2022 23 Budget